Covid-19 Updates

Intercap Lending is committed to the safety and well-being of our employees, clients, partners, and the communities we serve.

If you are a servicing customer and you have concerns about making your payment, please click here for more information about forbearance options.

Most Intercap employees are now working remotely through our secure systems. There are no delays in our loan origination services. However, delays may occur with certain services related to your loan, e.g. appraisals, title, escrow, and notary services. Intercap will keep parties informed of any possible delays.

Intercap has invested in technologies that allow us to continue at full-capacity and support a remote work and client experience as follows:

1. Online Applications – Home purchase and refinance applications can be submitted entirely online and through our Homebuyer mobile app.

2. Smart phone document uploads – Clients can use their smart phone to take pictures of their loan documents and securely upload them to their loan file using the Intercap Homebuyer App. Other secure document delivery options are available by contacting your Intercap loan officer.

3. E-signing – Clients can securely e-sign their loan documents from home. In most cases, final documents will need to be signed in the presence of a licensed notary.

4. Loan officers use video, text, email, and phone to stay in close touch with their clients, partners and support staff. They also have instant and secure, web-based access to loans and rates from home.

5. Agent partners have access to shared remote technologies such as the Homebuyer App, CRM, and Loan Status Updates.

6. Processors, underwriters, closers, funders, and other support staff are able to work from home with secure, web-based access to loan files. As a direct Fannie Mae, Freddie Mac and Ginnie Mae lender, most of our loans are underwritten in-house for faster closings.

7. Special considerations for employees and their families will be provided through internal communications. Loan servicing clients may also receive direct communications related to the impact of this unique situation.

We look forward to meeting you in person, but we are perfectly able to provide full-service loan support from our home to yours. Please be safe and well, and know that we are here for you.

Sincerely,

Intercap Lending

Remote Services: Resources and Information

Mortgage Rates are Still the Deal of the Century

It seems like mortgage rates are on a crazy roller coaster soaring up one day and down again the next. Here’s a few things to consider to get a great rate in today’s market.

1. Get your purchase or refi application in TODAY and ready to lock. Imagine riding a roller coaster without a restraint. That would be a scary ride! A rate lock lets you hold on to a low rate even if rates go up. When you have your application in and approved for a loan, your Intercap loan officer can lock you into a good rate when the time seems right, and you can continue to ride this crazy roller coaster without fear. The key is to get ready to lock with an approved application. Intercap Lending loan officers are experts at navigating rates and locking you in at the perfect time.

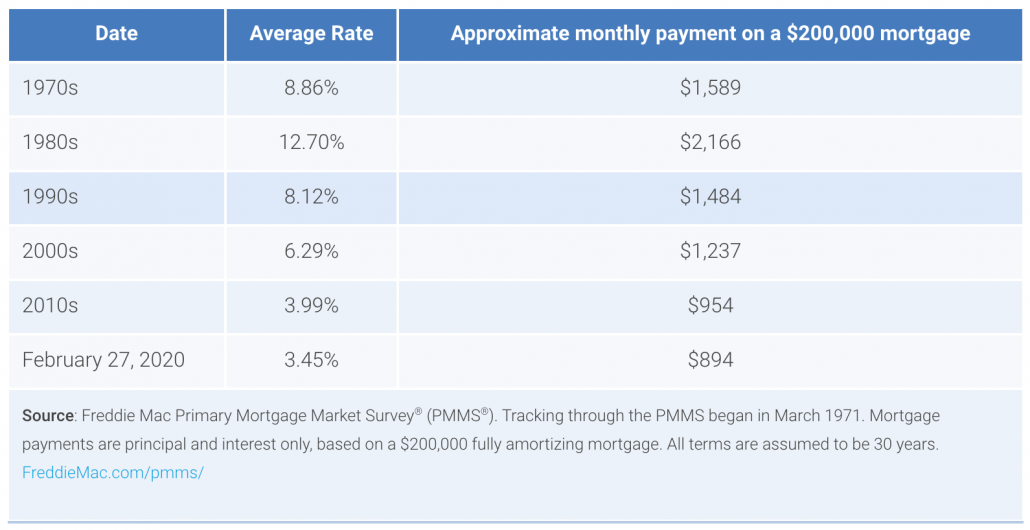

2. Even with the rates jumping up and down, we are still at a century low. Take a look at this chart provided by Freddie Mac showing the average rates since the 1970s. According to Freddie Mac, “Over the last 45 years, [mortgage interest rates] have ranged from a high of 18.63% (1981) to a low of 3.31% (2012). While it’s not likely that the average 30-year fixed mortgage rate will return to its record low, the current average rate of 3.45% is pretty close— all to your advantage.”

3. Low rates are not totally out of your control. Preparing to buy or refinance ahead of time can help you get a better interest rate. Credit scores, down payment (on a new purchase), debt to income ratios, and other factors can determine your actual interest rate. Added costs and rate increases are called Loan Level Pricing Adjustments. If you want to get the best rate at any time, learn what you can do to be ready. Intercap Lending loan officers can help you make smart financial decisions as you prepare to buy or refi. Don’t wait until you are ready to pull the trigger on a new purchase or refi and take your chances. Contact an Intercap loan officer today to get ready to make a smart move at the right time.

Find out how much you could gain from a refinance.

“When I decided to refinance I checked with some of the major banks but they offered overwhelming rates and steep out-of-pocket closing costs. Then I found Intercap who offered me in a fantastic rate. David was extremely helpful during the process, made everything clear from the beginning and all the promises he made about timing and ease were honored. We closed in 3 weeks and I had no out-of pocket costs. Most importantly, I have reduced my loan by 10 years while keeping monthly payments very similar to what I was paying in a 30-year term. I will also save $130k during the loan term! I had hesitated refinancing because the process when I bought my house two years prior had been so long, time-consuming and stressful that I didn’t want to go through that again. But this time I had to do so little that I hardly noticed the process. Now that it is over I strongly recommend both Intercap and its loan processor David for anyone’s refinancing needs.”

– Reviewed by Ruben

Are you locked into a low rate?

Mortgage interest rates are still hovering around the lowest rates in history. This is causing a refinance party you may want to join before rates trend up. Unfortunately, rates aren’t sitting very still right now. They are jumping up and down almost daily with economic and coronavirus concerns. Those of you who are a little trigger shy, here’s the secret to getting an amazing refinance rate.

- Get your refi application in as soon as possible, including all the required documentation. This doesn’t lock you into a rate but gets you ready to lock when rates go down.

- When your application is in, your Intercap loan officer will put you in his or her “ready to lock” group. Intercap loan officers watch rates very closely. They even receive instant notifications when rates are likely to rise or drop sharply. They can notify you of a drop and lock you in quickly. Trying to get the lowest rate is like shooting a moving target. Your Intercap loan officer is your personal sharp shooter when it comes to targeting great rates.

- Know what makes sense and get your rate locked. Waiting for the lowest possible rate can cause paralysis. No one has a crystal ball and rates this low have only been seen a couple times in history.

Find out how much you could gain from a refinance.

“When I decided to refinance I checked with some of the major banks but they offered underwhelming rates and steep out-of-pocket closing costs. Then I found Intercap who offered me in a fantastic rate. David was extremely helpful during the process, made everything clear from the beginning and all the promises he made about timing and ease were honored. We closed in 3 weeks and I had no out-of pocket costs. Most importantly, I have reduced my loan by 10 years while keeping monthly payments very similar to what I was paying in a 30-year term. I will also save $130k during the loan term! I had hesitated refinancing because the process when I bought my house two years prior had been so long, time-consuming and stressful that I didn’t want to go through that again. But this time I had to do so little that I hardly noticed the process. Now that it is over I strongly recommend both Intercap and its loan processor David for anyone’s refinancing needs.”

– Reviewed by Ruben

Want to make sure you are getting the best rate and terms? Go ahead, shop around. We encourage it!

We are confidant that we can compete with anyone on the best all-around rates, terms, and service. That’s why nearly all our reviews are 5-star!

Fed Rates vs Mortgage Rates

According the the Federal Reserve, “The relationship between the Fed’s monetary policy and long-term rates is weak and variable.”

On Sunday, March 15th The Federal Reserve announced a cut in benchmark interest rates by a full percent to zero. That’s right, zero percent. They also announced the central bank would buy no less than $700 billion in government and mortgage-related bonds in the coming months, all in an effort to “support the flow of credit to households and businesses [during this time of] anticipated hardship caused by the disruption to the economy.” The primary disruption being the coronavirus outbreak.

The last time the Federal Reserve took such a bold step was back in 2008 during the housing crises.

Many are wondering if Sunday’s announcement will effect long-term rates like the 30-year mortgage. There are a lot of pieces to this puzzle, but it’s important to know that Fed Rates are quite different from long-term mortgage rates. The Federal Reserve has some influence over short-term interest rates for loans with a maturity of less than a year, like money market rates and Treasury bills. Yet according to the Fed, “The relationship between the Fed’s monetary policy and long-term rates is weak and variable.”

In other words, Sunday’s announcement will likely not have an immediate or direct impact on long-term mortgage rates.

However, it is possible that these more recent measures, most importantly the purchase of government and mortgage-related bonds, could create a chain of events that indirectly impact mortgage rates. Only time will tell. We’re keeping a close eye on these events and how they effect mortgage rates so you can rely on us to provide the best mortgage lending rates and options.

Intercap Lending is committed to keeping you informed of mortgage lending programs, rates, and opportunities for residential purchases and refinance. As a direct Fannie Mae, Freddie Mac, and Ginnie Mae lender, we have the unique ability to underwrite most of our loans in house, saving our customers time and money. Please contact your Intercap loan officer for current rates and mortgage lending options.

Since mortgage rates could very well drop sometime soon, the best step to take now is to get your refi or purchase application in so your loan officer can lock you in when the rate drops.

I used my home equity to buy an investment property

I have two boys going to the same university and decided it was time to invest in a rental property rather than pay their rent for the next four years. I ran a rent vs buy scenario, projected the appreciation value and principle buy-down over the next five years, and found out I could net nearly $60,000 by renting out the other rooms to their friends. If it works out, I’ll likely keep this rental for my daughter who’s in high school thinking about going to the same university. My Intercap loan officer helped me run the numbers.

We picked out a brand new townhome and I was just about to put down 20% on an investment loan when interest rates took a plunge due to the Covid-19 scare. With my loan officer’s help, we realized I had enough equity in my home that I could get a cash-out refinance at 2.75% APR. Luck has it that I don’t have to put any money down, I can take out enough to finish the townhome basement for additional rental income, and my new mortgage payment will be considerably less than taking out an investment loan. This increases my investment CAP rate (expected rate of return) on the townhome so much that I’m thinking of buying another investment property.

You are crazy not to take advantage of these low interest rates. Whether you want to lower your monthly payment or tap into your equity, this is a great time to talk to an Intercap loan officer and discuss a purchase or refinance.

Mike Anderson