A 21-year old college student and part-time worker bought a 2-bedroom condo in Salt Lake City with less than $5,000 down. Emily’s monthly mortgage (including tax, HOA, and insurance) is $914 a month, but she rents out the other room for $600 a month, making her monthly living expense for her own place just over $300 a month.

Young home buyers across America are taking advantage of this life hack called house hacking – buying a primary residence and renting part of it out. This life hack is helping them afford their own place as they build future wealth. It’s genius, and Intercap Lending can help.

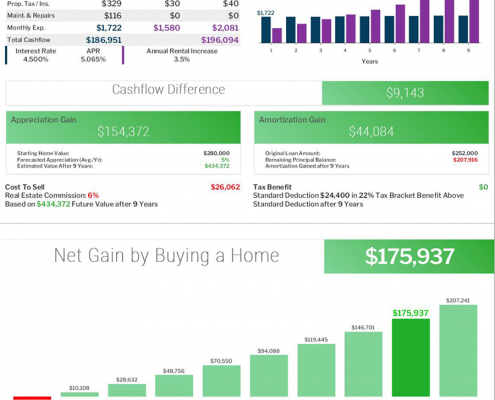

Not only is Emily saving money each month, her condo is appreciating while her monthly mortgage payments are paying down the loan principle. Together, this creates equity that grows over time. When Emily graduates, she plans to buy another property and rent out the condo. She’s thinking her next property will have a basement apartment she’ll rent out.

Emily said, “I never realized I could build a little business around owning my own place. Now I don’t have to deal with a landlord or throw away my money on rent.”

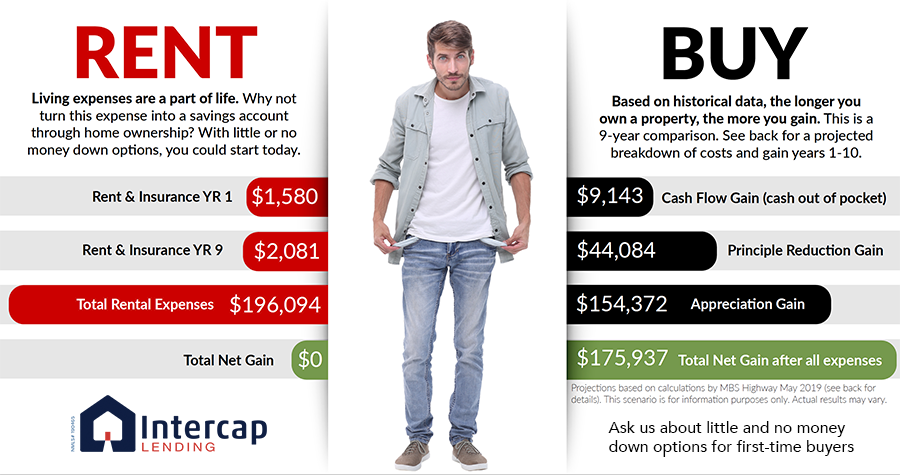

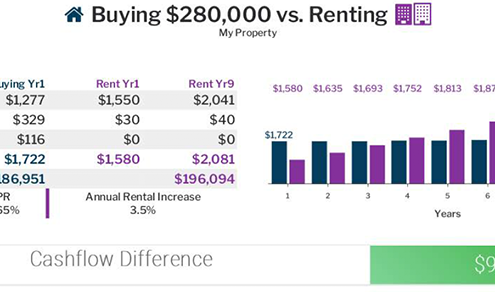

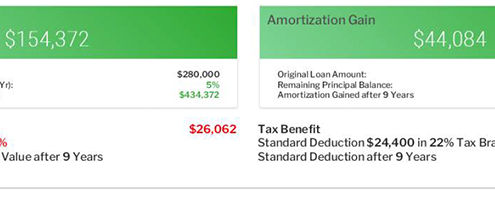

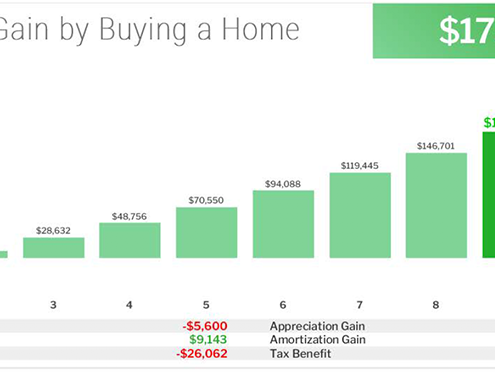

Buy vs Rent

There are federal government programs like FHA loans that help people buy their own property for little money down and still get a great interest rate. These programs are only for those buying their primary residence, and are even available to those who don’t have a long credit history.

Intercap Lending loan officers have a lot of experience with FHA loans and first-time homebuyers. Give us a call and we can help you like Emily. Even if you are not ready to buy right now, we can get you started on your Pathway to Qualification.

Click here to get started on your pathway to home ownership and wealth.

Watch this video to see how people are hacking into their homes across America.