Your Credit Score

Your FICO credit score can affect your mortgage interest rate

Know your credit score

When purchasing a home, your credit score holds significant importance as it reflects your track record in managing debt. A favorable credit score greatly facilitates and enhances the home-buying process, leading to increased affordability. A higher credit score opens doors to lower mortgage interest rates, making the overall experience more cost-effective. Use the form below to request information about your credit score.

Good Credit, Bad Credit, No Credit

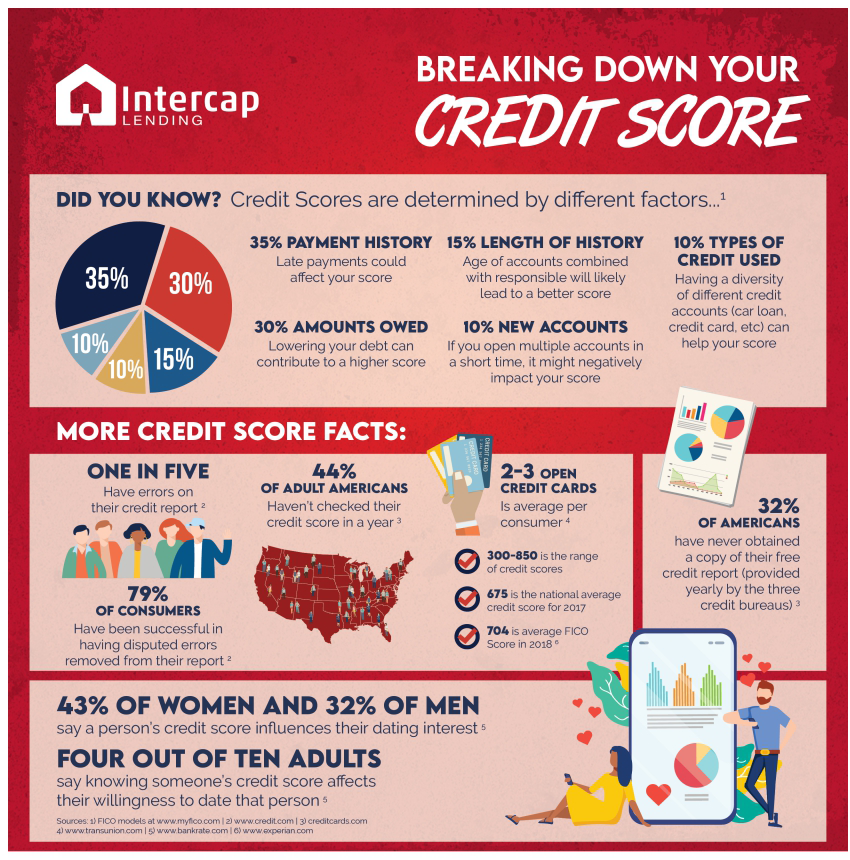

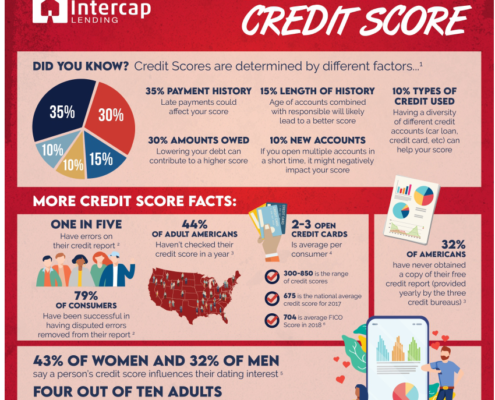

Your credit score plays a vital role in assessing borrower risk for lenders. The stronger your credit, the lower the risk, which enhances your chances of qualifying for a mortgage with a more favorable interest rate. FICO is the standard credit score used in home mortgages. FICO calculates your score by considering the mid-range value from the three primary credit bureaus: Experian, Equifax, and TransUnion. Each bureau assigns a credit score ranging up to 850, based on various reporting criteria (refer to the accompanying images for a detailed breakdown of a credit score).

A low FICO credit score can stem from credit issues such as late payments or bankruptcy, as well as limited credit history. For first-time buyers, a positive credit history established through responsible management of smaller transactions like credit cards or car loans helps mortgage lenders assess your financial obligations.

Poor credit can pose a significant obstacle to purchasing a home. Repairing and building credit is a gradual process that requires time. Rather than waiting and speculating about your credit standing or the necessary steps for credit improvement, it is advisable to consult with your Intercap loan officer. They can provide an accurate assessment of your current status and guide you on the path to qualifying for a home loan. Crafting a well-defined plan is the most effective way to overcome challenges posed by low credit scores.

Foreclosure and Bankruptcy

Typically, there are certain waiting periods before you can qualify for different types of home loans. For a VA loan, it is generally necessary to wait two years after a foreclosure or short sale. To obtain an FHA or USDA loan, the waiting period is usually three years. Meanwhile, qualifying for a conventional loan may require a waiting period of seven years. However, the waiting time to qualify for a home loan after the discharge of a Chapter 13 bankruptcy could potentially be shorter. To determine the precise timeline for your specific situation and to understand the necessary steps to purchase your next home, we recommend contacting your Intercap loan officer. They will provide you with accurate information about when you can qualify and guide you on the actions you may need to take.