Intercap Lending

Established 1978

Home ownership is one of life’s greatest achievements. Our mission is to make the loan process part of the celebration instead of an exhausting ordeal. Exceeding expectations with extraordinary service that’s uniquely personal to your life is where we live.

Welcome Home!

A Stress Free Home Loan means

- You get a direct lender with in-house origination, processing, underwriting, funding, and loan servicing. Home loans and refinance are all we do, and we are masters at our craft.

- You work with a dedicated loan officer who has the loan programs and knowledge to meet the specific needs of borrowers at every stage of home ownership (first-time buyer, mover-upper, relocator, investor, home finance planner, and down sizer).

- We strive to be clear-to-close long before deadlines, beating industry close averages by weeks.

- You never have to listen to hold music, get passed around, tell your story more than once, or wonder what’s going on with your loan.

- If you get junk mail/email, it’s not from us.

LEADERSHIP & CULTURE

“When the environment at work is one of encouragement, and one that meets the needs to live, to learn, and to feel valued and significant, we do more than survive – we thrive.” – Simon Sinek, Leaders Eat Last.

Intercap Lending thrives because of its people. It’s an environment of family and friends that watch out for one another. This “circle of trust” protects us from external threats so we can work together to move the organization forward.

Intercap producers and their staff are given the support they need to thrive, and the autonomy to build their business without management getting in the way. If you believe in cultivating an environment of mutual respect and dignity with a dogged determination to succeed, we should meet.

LOAN PROGRAMS & SERVICES

Intercap Lending is a direct Fannie Mae, Freddie Mac, and Ginnie Mae lender that offers a wide variety of loan programs and in-house underwriters who follow agency guidelines for faster closings. We have a large portfolio of FHA, VA, USDA, conventional, and non-conforming loans.

Our portfolio also includes specialty programs like 203k, down-payment assistance, reverse mortgages, and bank statement loans. We also have strong relationships with numerous jumbo loan programs and other niche lenders and investors.

Branch managers have the option of expense or retail accounting, with support for in-house processing, underwriting, and house accounts. We are committed to helping our branches and loan officers grow without unnecessary oversight or overhead.

Real estate agents, builders, and clients benefit from fast closings, integrated business systems, and an industry-leading CRM. Our co-marketing and advertising services assist with co-branded lead generation and nurture campaigns.

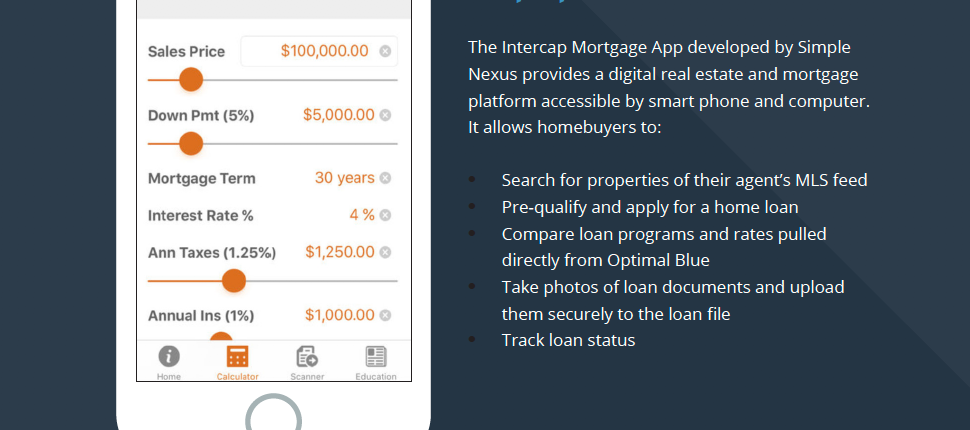

Intercap is an early adapter of industry-leading technology. The goal is simple; provide the best borrower experience from the first contact to the last mortgage payment. To this end, Intercap has overhauled every IT system to ensure complete integration from start to finish. Whether partnering with America’s largest title company on its FIRST e-closing nationwide (Done!) or rolling out the industry-leading servicing application in record time – you can be sure Intercap will be on the forefront of technology changes. Click here to review our marketing strategy and technology stack.

Loan officers and real estate agents can take advantage of this powerful sales training program developed by Mike Anderson, a national sales coach, author, and CMO of Intercap Lending. Participating agents and LO’s have experienced dramatic increases in their production without the cost and hassle of lead purchasing, expensive lead management systems, and awkward sales calls. CAPTIVATE is founded on the principles of understanding what our home buyers and sellers want most during each stage of the homeowner lifecycle, and effectively meeting their needs through a combination of service excellence, meaningful sales activities, and automated systems, unlocking the secrets to creating more raving fans and referral business.

OPERATIONS & SUPPORT

“You will never find a more dedicated and caring group of processors, underwriters, closers, and support staff. This is how we meet key performance goals like our 24-hour underwriting turn times and average close times at less than half of the industry average.” – Annette Lowder, COO

Intercap Lending takes great care of its operations and support staff, and in turn, they take extraordinary care of our loan officers, partners, and clients. This teamwork of dedicated employees has helped us establish a reputation of on-time closings, fewer conditions, and quicker turn-times.