Arizona First Time Homebuyers

For many first-time buyers (FTB), buying a place to live is more about cost and logistics than, “Is it worth it?” Yet with housing prices climbing, two FTB camps are forming: FOMO (fear of missing out) and HTHMC (hope the housing market crashes). If you are in the second camp, please read this article and then circle back, “Is the Housing Market Set to Crash.”

For those in FOMO mode or simply unsure about buying, here are some hard numbers to better understand the financial considerations of buying versus renting.

US Statistics

- Across the US, 64% own their home

- US homeowners spend an average of $9,552 a year on their mortgage, interest, taxes, and insurance

- US renters spend an average of $9,447 a year on rent (surprising how close this is)

Bringing this closer to home, here is what the average Arizona renter spends per month*

| County | 1 bed rent | 2 bed rent |

| Maricopa County | $1,032 | $1,251 |

| Coconino County | $1,062 | $1,315 |

| Yavapai County | $822 | $1,051 |

| Cochise County | $677 | $874 |

This means the average rent paid out over 5 years in Maricopa County for a 2-bedroom is roughly $75,060. There’s no return on that rent, at least not for the renter.

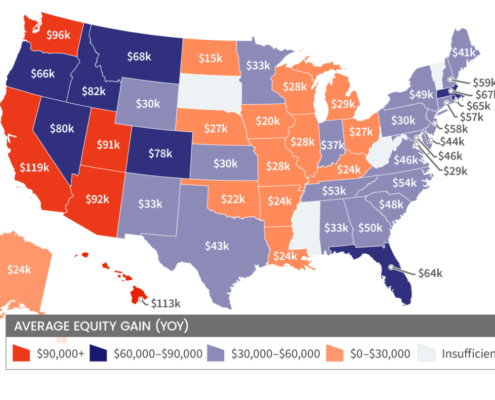

In contrast, the average Arizona home owner gained $92,000 in equity LAST YEAR. This is where FOMO sets in. So, what if it takes five years to gain that much equity? Or even 10 years. Rent produces no net gain. Home Ownership creates gain from living expenses you are going to pay anyway. That’s the beauty of home ownership no matter when you jump in.

What about the down payment? Since the 1950’s, the US government has encouraged its citizens to buy homes. Research supports that home ownership creates stronger communities, lowers crime, provides stability for children, and overall bolsters the economy. Subsequently, our government has backed first-time mortgage lending programs with little or no money down. These programs are made to keep rates and payments affordable without a lot of money out of pocket or higher credit score requirements. This isn’t a snare or scam. There’s no catch. It’s affordable housing where you get to own your property and gain from the equity it builds over time. If 83% of the average American’s net worth is in their home, how do you plan to build your net worth?

A big reason affordability is a factor when buying a home is most buyers want to move up. For example, they live an apartment and want to buy a home with a yard. The idea of moving from an apartment to a condo seems like a lateral move instead of a move up. Why save up for a down payment and pay a little extra each month for a similar living situation? The best reason: Equity! Buy a condo that’s equivalent to your current monthly living expenses and know that every month you pay that mortgage you are building equity. When you are ready to move up, you can leverage that equity for a nicer place even if your budget hasn’t changed. You could keep the property, rent it out, and build wealth through multiple property ownership. Any way you slice it, you have something gained (equity) over something lost (rent).

Contact your Intercap Loan Officer and Realtor to create a First-Time Buyer Plan. They can help you consider all the logistics and financial considerations of a home purchase.

*Visit www.rentdata.org/states/arizona/2021 for a full list of Arizona rent data