Is the Housing Marketing Set to Crash?

Sharply rising housing prices over the last couple years seem eerily similar to the 2008 housing crisis. With many of today’s buyers taking advantage of historically low interest rates, which has pushed demand and housing prices up dramatically, some are worried that we are repeating history. Is the real estate market setup for another crash?

As the saying goes, history has a way of repeating itself. At least if we make the same mistakes. Using the early 2000s as a history lesson, let’s compare the root causes of the rising housing prices during each period.

In the early 2000s, housing demand was fueled by specialty mortgages that became mainstream. Stated income loans allowed buyers to “state” how much they made without having to produce any evidence. It wasn’t uncommon for a waiter or cashier to list a $10,000 a month salary to buy a more expensive home.

Negative amortization and interest-only loans allowed buyers to purchase homes they likely couldn’t afford on their current budget, even if they were honest about their income. NINJA loans became a common slang term of the time for home buyers with “no income, no job, and no assets.” As odd as it sounds today, buying a home in the early 2000s was as easy as signing loan papers without any verification.

The ease of buying real estate in the early 2000s naturally led to higher demand and rising prices. If anyone could buy, then nearly everyone did. And at an alarming rate. I knew a buyer in California who made $19 an hour and over the course of two years bought 17 homes. His goal was to rent them for a year or two to lessen his capital gains tax and then sell them at an outrageous profit. He owned 12 homes when the market crashed.

Because of the extreme demand for real estate in the early 2000s, homes appreciated in the high double digits. Unfortunately, when the housing market began to slow, there was no economic foundation to keep the floor from collapsing. Many people bought homes they couldn’t afford, counting on the properties to continue to rise at such a rate that they could flip them into a big profit or somehow afford them at a future time.

Not everyone who suffered from the 2008 housing crash was a wrongdoer. The economic collapse led to lost jobs, a flood of foreclosures, and many other unfortunate consequences that impacted the innocent too. It’s a history no one wants to repeat.

To avoid a housing catastrophe of this scale ever again, the U.S. government stepped in to create new agencies and legislation. In 2011, the Consumer Financial Protection Bureau (CFPB) enacted thousands of pages of new regulations to protect consumers and the U.S. economy from the unfortunate mismanagement of real estate lending and the valuation of mortgage-backed securities. Subsequent state and federal agencies continually monitor and audit financial institutions to ensure this doesn’t happen again.

Fast forward to 2020 and we are facing another accelerated appreciation in housing prices. The question everyone is asking, “Are we in another housing bubble?”

Rapidly rising prices certainly make it harder for some buyers to afford housing, yet the natural result of supply and demand should keep our free market stable, as long as nothing fishy or illegal occurs. Luckily, the CFPB and the many other regulators are in full force to protect consumers and the economy from a similar housing crash.

When the economic consequences of Covid hit the world in 2020 and 2021, the U.S. government stepped in to help stimulate its economy by lowering interest rates and purchasing a large number of mortgage-backed securities. Ironically, consumer spending and residential housing have the biggest impact on economic growth and stability in our country. Helping homeowners buy or refinance at a lower interest rate is a very powerful stimulus, and it worked. Demand for new homes was so strong in 2020 and 2021 that housing prices naturally rose in many U.S. markets.

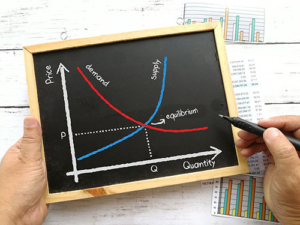

As you may recall from your high-school economics class, supply and demand are counterweights that naturally regulate prices in a free market. Another unexpected Covid consequence was a disruption in the supply chain of the goods and labor needed to build new homes. When builders could not adequately bridge the gap between existing home sales and the demand for new homes, home prices naturally went up, simply because there were more buyers than available homes. Combining historically low interest rates with a lack of housing inventory and we got a double whammy for housing appreciation.

As you may recall from your high-school economics class, supply and demand are counterweights that naturally regulate prices in a free market. Another unexpected Covid consequence was a disruption in the supply chain of the goods and labor needed to build new homes. When builders could not adequately bridge the gap between existing home sales and the demand for new homes, home prices naturally went up, simply because there were more buyers than available homes. Combining historically low interest rates with a lack of housing inventory and we got a double whammy for housing appreciation.

As the U.S. economy and supply chains begin to stabilize over the next year or so, which is a constant ebb and flow, housing supply should naturally increase, interest rates will likely rise to a more sustainable rate of around 4%, and housing prices should appreciate closer to the 40-year average of 4.5%. Altogether, housing inventory should rise, and prices should subside. Of course, every market is unique, and some housing markets will continue to grow at faster rates than others.

As far as a housing crash is concerned, there does not seem to be anything beyond the normal supply and demand counterweights in play. Overall, economic considerations of inflation, interest rates, and consumer confidence will always play a role in where the economy goes at any given time. Surprises like the Covid epidemic can throw a wrench into an otherwise stable economy. However, what happened in 2008 is very different than what is happening in 2021, and that’s a good thing.

Moving forward with a long-term view of free market stability (and correction when needed) is a safe bet, particularly when it comes to housing. Owning a home will always be one of the strongest plays in securing financial and personal security in this country.

10 cities where housing prices are expected to rise over 20% in 2022

10 cities where housing prices are expected to rise over 20% in 2022

1 – Austin, TX

2 – Provo, UT

3 – Phoenix, AZ

4 – Ogden, UT

5 – San Diego, CA

Click Here for the full list