What real estate agents need to know about seller concessions and a temporary rate buydown

Whether you are on the listing or buying side, the temporary rate buy-down as a seller concession is your client’s winning ticket in today’s housing market. It’s vital that real estate agents understand how this remarkable seller concession gets homes sold when interest rates are high. Or at least higher than we’ve been used to.

What is a temporary buy-down concession?

A temporary buy-down concession is offered by the seller. It lowers the buyer’s interest rate, typically for a period of one to three years. Using this seller concession towards a temporary rate buy-down makes the mortgage payment more attractive to home buyers in a time of higher interest rates.

The most notable difference in today’s housing market is the mortgage interest rate. This has contributed to more inventory, giving today’s buyers more homes to choose from with less competition. Sellers competing for today’s buyers can essentially give buyers what they have wanted for years, making their listings hot commodities again.

How does the temporary rate buy-down work?

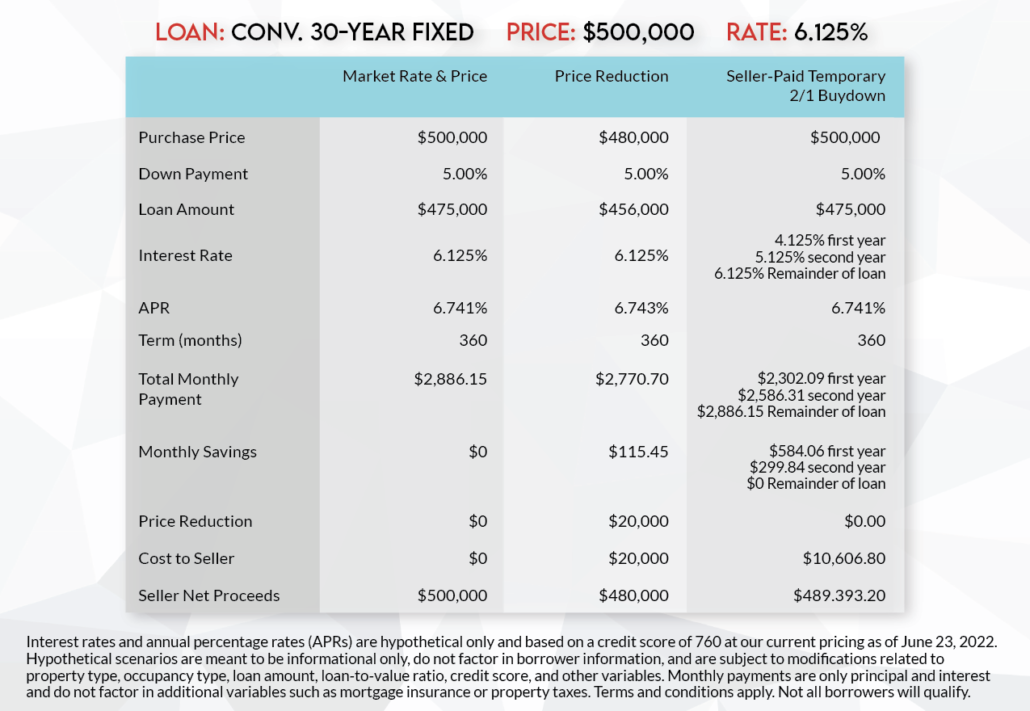

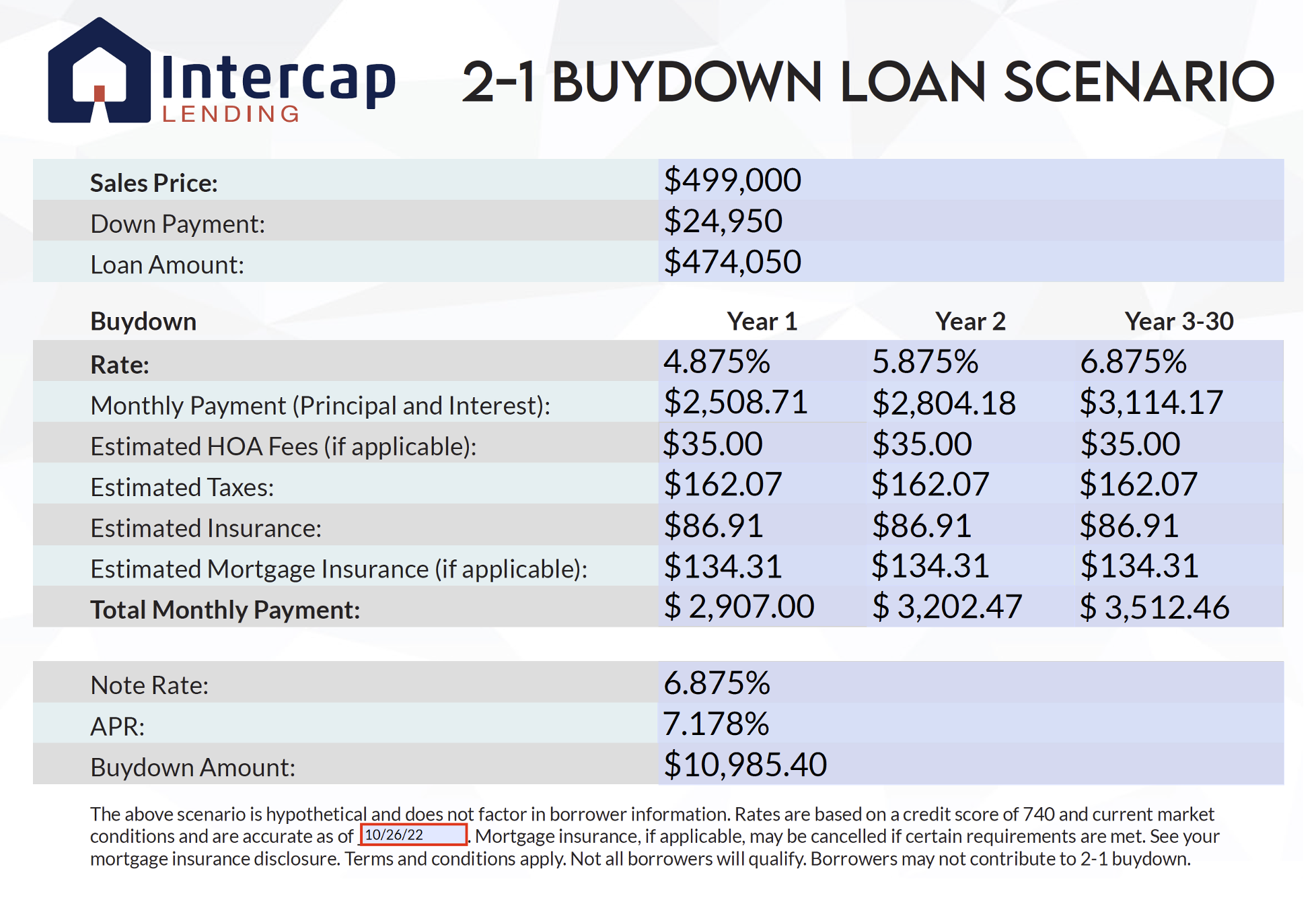

The temporary rate buy-down is applied as a seller’s concession to a fixed-rate mortgage. For example, if a buyer qualifies for a 6.125% fixed-rate mortgage, the seller can temporarily alleviate the buyer’s interest payment on a 2/1 buy-down by 2% the first year and 1% the second year. The cost to the seller is surprisingly affordable (as opposed to a significant price reduction) with a considerable discount in the buyer’s monthly payment for the first one to three years. See the chart below for an example scenario of the 2/1 buy-down.

There are three temporary rate buy-down options: 3/2/1, 2/1, and 1/0. The numbers represent how many interest rate points are taken from the qualified note rate. Each reduction is for 12 months, so three numbers in a sequence represent each year’s rate reduction for those three years.

The buyer qualifies for a typical fixed-rate mortgage, such as FHA, VA, conventional, conforming, and non-conforming mortgages. In other words, this is not a new or unique loan type. The reduction is applied to the rate the buyer qualifies for. Since this reduction is applied to a fixed-rate mortgage, the remaining years after the reduction will not change as in a variable rate mortgage.

Why is the temporary rate-buy down concession a good option?

The monthly mortgage payment is an important buyer consideration when selecting a home. A rate reduction up to three percentage points can make a significant difference in the buyer’s payment, even as a temporary reduction. Use the rate buy-down calculator to estimate the potential monthly savings for your clients.

A lot can happen in two to four years. Here are some considerations for buyers who may be concerned about a temporary buy-down.

• Rates go up: Since this reduction is applied to a fixed-rate mortgage, the rate will never go higher than the qualified note rate.

• Rates go down: The buyer can refinance and apply any un-used portion of the concession towards their refinance.

• Rates stay the same: Homes will continue to appreciate over time, just as rents will rise. Owning a home has always been a long-term investment advantage even if all other factors remain equal.

How to make this work for your clients

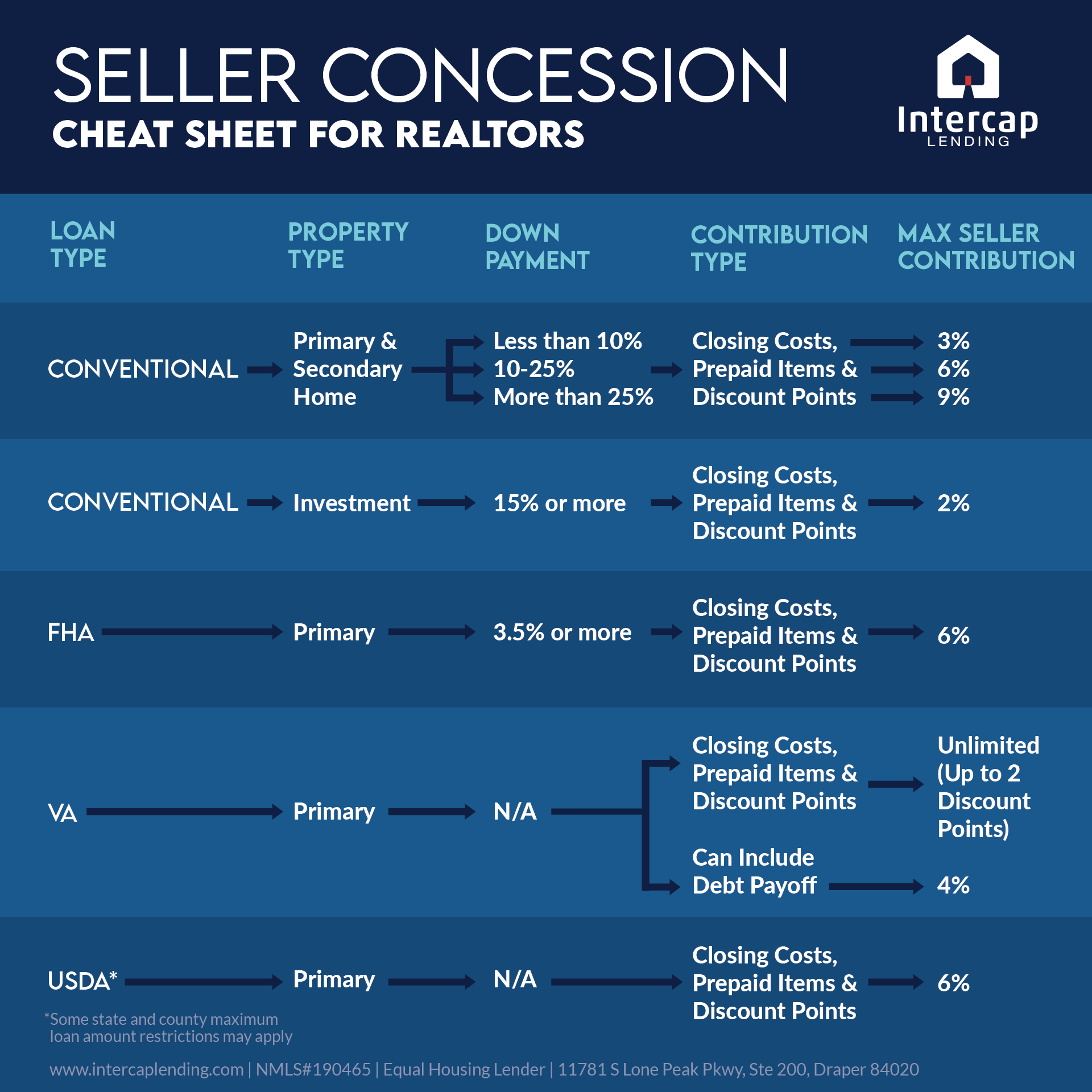

On the buyer side, write your offers requesting a seller concession for the amount allowed by the loan type the buyer is qualified for. You may be surprised how many sellers are willing to provide a reasonable concession in today’s market. Not to mention how many buyers will jump off the fence they’ve been sitting on for the last several months.

See the chart below and ask your buyer’s lender what the concession amount should be. If the cost of a buy-down is less than the total amount the seller can contribute, request to use any remaining amount towards buyer closing costs the seller can pay.

On the listing side, talk to your seller about advertising the listing to include seller concessions, including a temporary rate buy-down. Have your Intercap loan officer create a co-branded flyer for your listing that includes a rate buy-down scenario.