Buying Your First Home

5 things you need to know to buy your first home

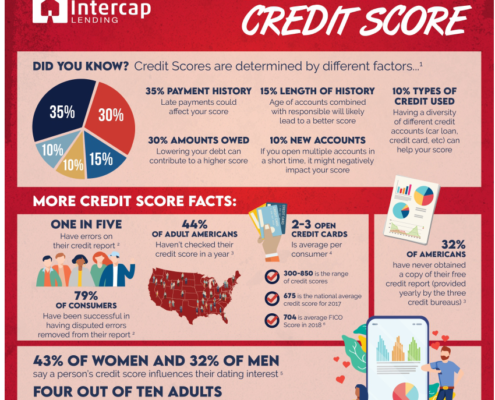

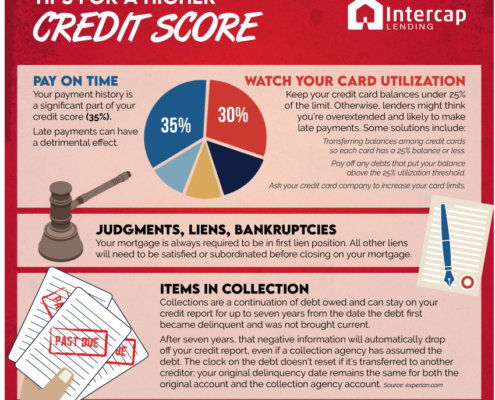

#1 Check your Credit Score

A 620 or higher credit score is recommended. There are also options for lower credit scores. A credit score for a home purchase is called a FICO score, which may be different from other credit scores. Click below for a free, no obligation FICO score in minutes. Your Intercap loan officer can also help you with suggestions on how to raise your score.

#2 Save enough money to cover closing costs and down payment (it’s less than you think)

Many first-time homebuyers qualify for little or no money down programs like state housing, FHA, and USDA loans. This government assistance not only lowers the down payment requirement, it also keeps the interest rate down so the monthly payment is manageable. There may also be first-time buyer incentives and grant programs available to help with down payment and closing costs. Down payment and closing costs vary by program and other considerations, so meeting with an Intercap Loan Officer to discuss your options is the best way to find out what’s available.

#3 Earn enough income to cover the monthly mortgage payment

You need to show a steady income, usually from employment. This can be hourly, salary, or self-employed. Many first-time homebuyers don’t realize how close they are to qualifying for a mortgage. Understanding your best options based on your goals and situation is what we do. We never pressure anyone to buy before they are ready, and we are happy to work with you even if it takes months or years to buy. This is an important decision.

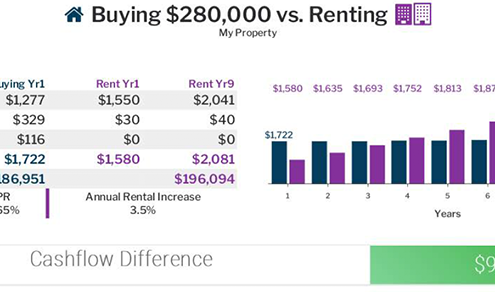

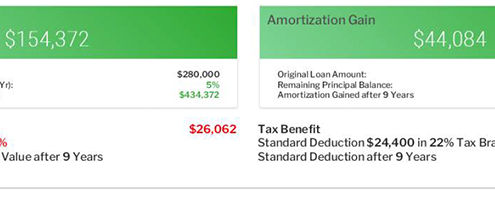

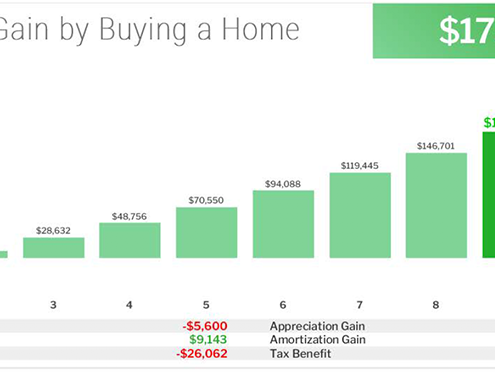

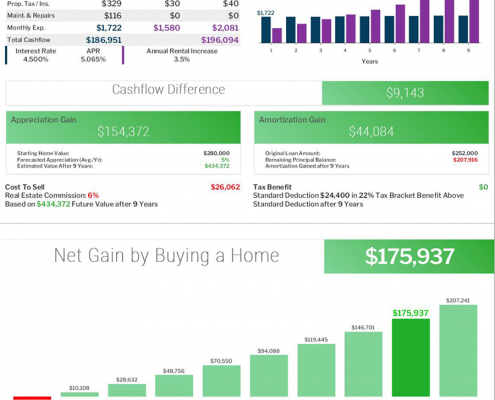

#4 Decide if it’s worth buying versus renting

Buying a home can be a big commitment, but it can also offer big rewards. When you consider how much you already pay to live somewhere, you could turn this rent into an investment. Let us calculate a rent vs buy projection so you can see the power of investing in your own property. If others can do it, so can you.

#5 Do’s and Don’ts as you get ready to buy

Do these

- Deposit your paychecks or other earnings into a bank account

- Pay your bills on time

- Submit your tax returns

- Speak to an Intercap loan officer and put together your Pathway to Qualification plan, including a credit check

Don’t do these

- Quit your job

- Apply for bankruptcy

- Make big purchases that could negatively affect your credit or debt-to-income ratio

Mortgage Interest Rate Shopping

Great Mortgage Interest Rates and 5-Star Service

How to get the best mortgage interest rate

The actual interest rate a mortgage applicant qualifies for depends on several factors: The current market rate, down payment, the applicant’s credit score, the type of loan, the home purpose, and any loan level pricing adjustments by the issuer and lender. A borrower can also buy down the rate, and the market rate can change at any time. That’s why providing an interest rate without a full application is just an estimate, and sometimes not a very good one. The first step in understanding your qualifying interest rate is applying for a loan and speaking to a loan officer about your options. Once you apply, you can compare differences in terms, fees, and interest rates with other lenders using the Loan Estimate they are required to provide. Below is a simple guide to getting the best interest rate.

How to compare mortgages and lenders

Once you complete a loan application, your lender is obligated to provide you with a Loan Estimate, which itemizes the rate and fees associated with the mortgage. This estimate enables you to compare it with other offers. However, it’s crucial to remember that the proposed rate is subject to change unless it is locked, and fees can vary depending on the loan program. Therefore, comparing “apples to apples” requires a bit more effort than simply requesting a rate quote. Here are the four puzzle pieces that collectively determine the cost of a home mortgage.

Puzzle Piece #1 – Loan Type

When it comes to selecting a mortgage loan, you’ll discover numerous options depending on factors such as the desired loan amount, the purpose of the home (owner-occupied, second home, or investment property), and the down payment amount. Moreover, there are specialized loan programs tailored for rural areas, first-time homebuyers, veterans, and properties in need of renovation. Among the most commonly encountered loan programs are FHA, Conventional, Jumbo, USDA, and VA loans. The loan program itself, as well as the loan issuer, can influence the interest rates, terms, and associated fees.

To navigate this multitude of choices effectively, an Intercap lender can assist you in determining the loan type that aligns best with your specific circumstances and the available options. By considering the various pieces that form this mortgage puzzle, along with the appropriate loan type, you can make informed decisions regarding the most suitable loan program for your needs.

Puzzle Piece #2 – Down Payment

Determining the amount you can or should put down is an important decision that can impact your interest rate. According to Fannie Mae, the average down payment for a new home purchase is approximately 8%. Generally, the more you put down, typically up to 25%, the more favorable the interest rate becomes. This is because the home acts as collateral, and a larger down payment reduces the investor’s risk. However, it’s important to consider your budget and financial situation when deciding on a down payment amount, especially when dealing with properties worth several hundred thousand dollars or more. Opting for a down payment of 25% may not be feasible or in your best interest, even if it results in a lower interest rate. Many buyers find it more sensible to pay more towards monthly payments instead of making an excessively large down payment at one time. Ultimately, striking a balance between your budget, available cash, and financial goals is key.

Puzzle Piece #3 – Monthly Loan Payment

Determining how much you can comfortably afford each month is a crucial decision that significantly impacts your mortgage. It involves budgeting and considering your cash flow, while also factoring in your long-term investment strategy. Some buyers may choose to buy down points, which involves making a one-time payment to reduce the interest rate. Others may explore special loan programs designed to keep monthly payments manageable, even if a portion of the funds is allocated towards fees instead of paying down more principal.

It’s important to recognize that home ownership is an appealing long-term investment due to the potential equity it offers. This equity is a combination of appreciation in the property’s value and the reduction of the loan’s principal. Despite the presence of additional fees, the potential for long-term financial gain makes homeownership an attractive option.

By carefully considering your budget, cash flow, and long-term investment goals, you can make informed decisions regarding how much you can afford each month and choose mortgage options that align with your financial strategy.

Puzzle Piece #4 – Closing Costs

The majority of mortgage fees are generally consistent among lenders and their affiliates, such as those associated with title and appraisal services. However, it’s worth noting that there can still be some variations in these fees. To effectively compare fees from one lender to another, reviewing your Loan Estimate is essential. This document provides a detailed breakdown of the fees involved. Additionally, it’s important to consider that closing costs can differ based on the specific loan type. Therefore, when comparing costs, it is crucial to ensure you are comparing similar loan types to make an accurate apples-to-apples assessment. Loan fees can encompass factors like mortgage insurance and options such as purchasing a lower interest rate. By carefully examining these fees and comparing them across lenders, you can make an informed decision that aligns with your financial goals.

Puzzle Master

A skilled mortgage loan officer acts as the puzzle master, adept at fitting together the various pieces to structure the ideal loan for their clients. Since 2008, regulations have been in place to prevent mortgage companies from compensating loan officers differently based on the selected loan type or the fees charged by the lender or investor. These regulations serve to protect homebuyers from unfair pricing practices. In today’s residential mortgage landscape, a competent loan officer is committed to securing the best loan, rate, and terms that align with their clients’ best interests. There is no incentive to overcharge clients, and engaging in such behavior carries significant consequences.

A skilled mortgage loan officer acts as the puzzle master, adept at fitting together the various pieces to structure the ideal loan for their clients. Since 2008, regulations have been in place to prevent mortgage companies from compensating loan officers differently based on the selected loan type or the fees charged by the lender or investor. These regulations serve to protect homebuyers from unfair pricing practices. In today’s residential mortgage landscape, a competent loan officer is committed to securing the best loan, rate, and terms that align with their clients’ best interests. There is no incentive to overcharge clients, and engaging in such behavior carries significant consequences.

What truly matters is the loan officer’s familiarity with available loan programs and options, the time they invest in understanding their clients’ needs and preferences, and the lender’s ability to efficiently deliver and execute the loan. At Intercap Lending, our loan officers have the freedom to work with any mortgage lender or broker, yet they choose to work at Intercap Lending due to the advantages we offer in navigating the intricacies of the entire mortgage puzzle.

Intercap provides access to numerous loan programs, maintains essential relationships with key investors, and possesses direct lender relationships with Fannie Mae, Freddie Mac, and Ginnie Mae. As a result, Intercap has the capacity to underwrite most loans internally, ensuring more efficient execution. With our expertise and resources, we strive to deliver the best possible outcomes for our clients throughout the mortgage process.

Intercap Lending has been a private mortgage lender since 1972 and as you may have noted from our reviews, our loan officers maintain a 4.9 star rating from Zillow, Google My Business, Facebook, and other third-party review sites. Read through our reviews and you will notice that client satisfaction is based on rate and all these puzzle pieces.

And when timing counts with mortgage lending, which it always does, our turn times are something to brag about (half the time of the industry average). Read our reviews HERE and we’ll let our clients do the talking.

Free Contact Management System for RE Agents!

Intercap Lending has invested in a robust yet simple-to-use contact management system called Total Expert. It is specifically designed for real estate and lending professionals with all the features you need to keep your clients happily engaged as you help them buy and sell homes.

Total Expert includes features like automated email and text campaigns, single property websites, open house flyers, and social media integration. Best of all, we’re offering a free version to any real estate agent who wants to give it a spin – no strings attached.

Request your free Total Expert Account – no strings attached

Total Expert

The best way to stay in contact with your SOI when you can’t be there in person is with a contact management system or CMS. Your CMS should allow you to accomplish the following

- Manage your contacts in one place. A good CMS will help keep you organized when you have clients at different stages of the life cycle and sales pipeline. You may also have other tools that need access to your contacts, like a lead management system. A good CMS will provide the ability to connect these systems and centralize your contact database.

- Setup automated and instant messaging. Consistent and quality communication is the key to growing your business. A good CMS will allow you to create email and text messages to your clients, partners, team members, and yourself during the different stages of your business workflows and the homeowner lifecycle so everyone on your team knows what’s going on and what to do.

- View real-time data of your business. Once your CMS is setup and you begin using it to manage your contacts and communications, you will be able to access real-time reports of production, workflows, marketing campaigns, and other key performance indicators.

- Create campaigns and advertisements. Many of the real estate-specific CMS platforms have marketing engines to dynamically create open house flyers, single property websites, landing pages, IDX websites, and social media posts that pull directly from your MLS listings.