Cartoon artwork courtesy of Cartoonstock.com with a Website/Blog/Electronic Publication – Commercial license.

Home Refi Rates Go Up Soon

Sep 29, 2020

It’s not often we can predict the future of mortgage rates, but Fannie Mae and Freddie Mac decided to issue a 0.5% fee for all refinances** that will likely start impacting rates this week or next. They are calling this an “adverse market fee” due to the potential negative impact of the Covid-19 pandemic.

Intercap Lending can provide a locked-in rate BEFORE this fee is imposed*, but you need to act soon.

*This is not a promise to lend. Applicants must qualify with a complete refinance application to be considered for a locked rate. Please contact your Intercap Lending loan officer for details. **For more information on this new refinance fee, click HERE.

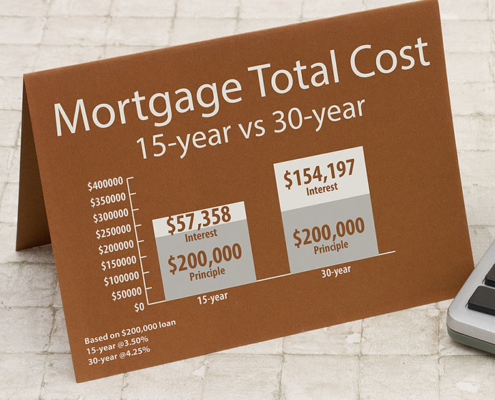

Find out how much you could gain from a refinance.

Intercap was amazing!! Not only did they save us over $300 month on our re-fi they were professional, on top of it and a pleasure to work it!

– Reviewed by Haley Del Andrae