Buying Your First Home

5 things you need to know to buy your first home

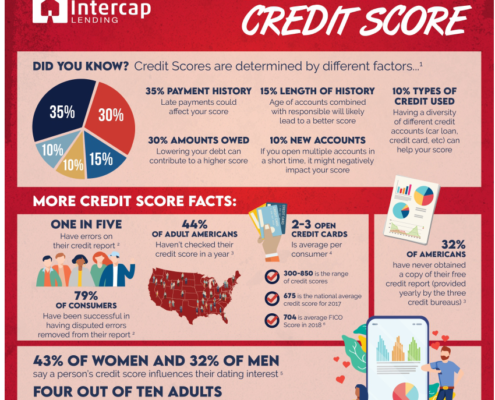

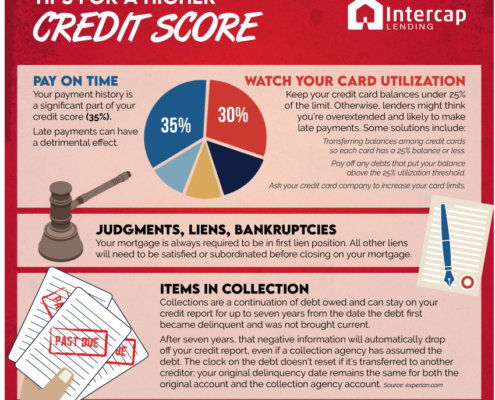

#1 Check your Credit Score

A 620 or higher credit score is recommended. There are also options for lower credit scores. A credit score for a home purchase is called a FICO score, which may be different from other credit scores. Click below for a free, no obligation FICO score in minutes. Your Intercap loan officer can also help you with suggestions on how to raise your score.

#2 Save enough money to cover closing costs and down payment (it’s less than you think)

Many first-time homebuyers qualify for little or no money down programs like state housing, FHA, and USDA loans. This government assistance not only lowers the down payment requirement, it also keeps the interest rate down so the monthly payment is manageable. There may also be first-time buyer incentives and grant programs available to help with down payment and closing costs. Down payment and closing costs vary by program and other considerations, so meeting with an Intercap Loan Officer to discuss your options is the best way to find out what’s available.

#3 Earn enough income to cover the monthly mortgage payment

You need to show a steady income, usually from employment. This can be hourly, salary, or self-employed. Many first-time homebuyers don’t realize how close they are to qualifying for a mortgage. Understanding your best options based on your goals and situation is what we do. We never pressure anyone to buy before they are ready, and we are happy to work with you even if it takes months or years to buy. This is an important decision.

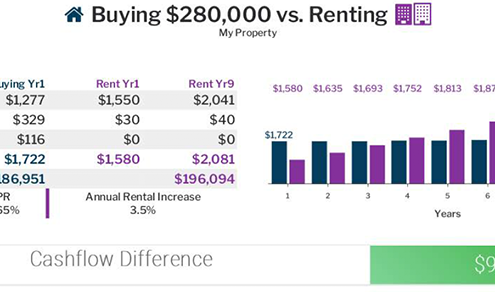

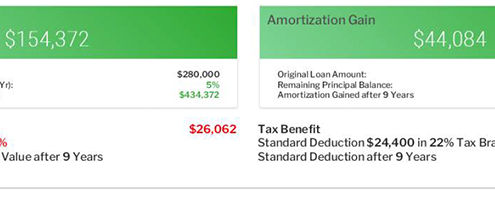

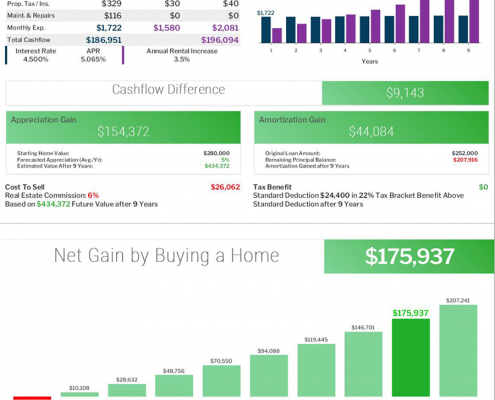

#4 Decide if it’s worth buying versus renting

Buying a home can be a big commitment, but it can also offer big rewards. When you consider how much you already pay to live somewhere, you could turn this rent into an investment. Let us calculate a rent vs buy projection so you can see the power of investing in your own property. If others can do it, so can you.

#5 Do’s and Don’ts as you get ready to buy

Do these

- Deposit your paychecks or other earnings into a bank account

- Pay your bills on time

- Submit your tax returns

- Speak to an Intercap loan officer and put together your Pathway to Qualification plan, including a credit check

Don’t do these

- Quit your job

- Apply for bankruptcy

- Make big purchases that could negatively affect your credit or debt-to-income ratio