Homebuyers are Back, Stronger than Expected

Homebuyers are Back, Stronger than Expected

Mortgage applications rose for a third straight week as pent up demand and low interest rates strengthen the housing market.

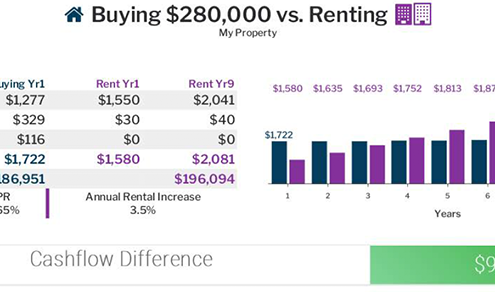

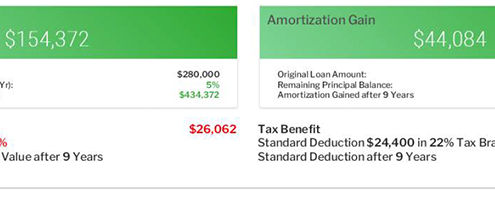

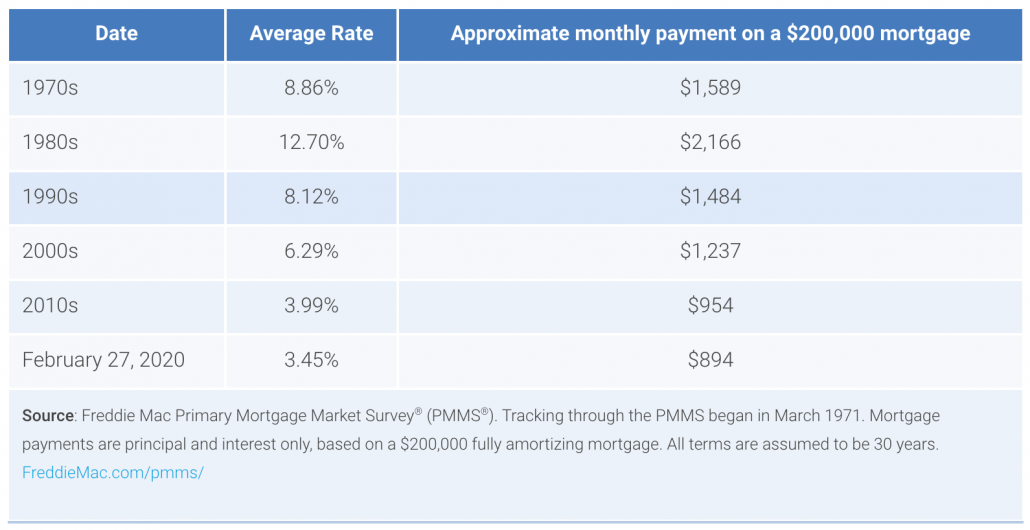

Homebuyers are heading back into the market as our economy begins to reopen. And the numbers are stronger than anticipated according to a weekly Mortgage Bankers Association (MBA) report. Mortgage applications to purchase a home rose for the third straight week, up 7% from the previous week. Purchase volume was still down 19% annually, but this number is shrinking by the week. Just three weeks ago purchase volume was down 35% annually. Pent up demand for housing and low interest rates are driving this increase, particularly in states like Utah, California, Arizona, and Texas. Refinance applications decreased 2% for the week, but were still 210% higher than a year ago.

The average contract interest rate for a 30-year fixed-rate mortgage decreased to a record low this week of 3.40% from 3.43%

Buyers seem to be responding better to agents and listings that are able to offer virtual showings and live tours using technology like Matterport, drone, and video conferencing. The Captivate Sales Coaching program has been teaching real estate agents how to use this technology for over two years, and recently released a free class for agents called Virtual Home Shows. You can attend a live training session or view a recorded class from their Facebook page at www.facebook.com/captivatesalescoaching.